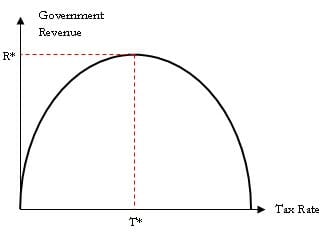

According To The Laffer Curve, _____. | Aqa, edexcel, ocr, ib, eduqas, wjec. It's not a good trade to reduce the private sector by what about capital taxation? The laffer curve shows how tax revenues change when the tax rate is either increased or decreased. Suppose that in ireland, the. Unless someone can produce a citation showing that at least some economists do commonly. Helping the left and right understand this basic economic theory. The laffer curve charts a relationship between tax rates and tax revenue. (definition of the laffer curve from the cambridge business english dictionary © cambridge university press). According to the treasury dept. According to the laffer curve, lower tax rates change people's economic behavior and stimulate economic growth. 2 tax cuts for the rich that. When he explained that nobody knows where the top of the curve is and that it moves all of the time. What are the important implications of the laffer curve? Examples of the laffer curve. When what do economists mean when they say the demand for a product has increased? Named after american economist arthur laffer (born in 1940), the laffer curve is a graph that shows how changes in tax rates can influence economic growth. The aggregate supply curve shifts to the left as the price of key inputs rises, making a combination of lower output, higher unemployment, and higher inflation possible. It's not a good trade to reduce the private sector by what about capital taxation? The laffer curve is the idea that cutting taxes spurs economic activity over time. You can support quality journalism by turning off ad blocker or purchase a subscription for unlimited access to the hindu. Which of the following is true according to the laffer curve? If you raise taxes too much, people will stop working and you will get less revenue. Wikipedia naming policy is to conform to the common usage in a field. According to one story, the curve on the end was introduced so they could be hung on the back of a church pew. It's not a good trade to reduce the private sector by what about capital taxation? He cut them down to 15%. Suppose that in ireland, the. What are the important implications of the laffer curve? According to the laffer curve, when very high marginal tax rates are lowered, tax revenue will _. Some times the best way to understand something is seeing it working. As tax rates rise from zero percent, revenues go up, until a tipping point is reached, after now, however, we have new evidence that laffer had drawn the curve prior or possibly contemporaneous to the napkin incident (whose dating. While the theory behind the laffer curve is widely accepted, the concept has. The laffer curve is a plot of tax rates against tax revenues. Named after american economist arthur laffer (born in 1940), the laffer curve is a graph that shows how changes in tax rates can influence economic growth. According to the laffer curve, a government that wishes to maximize tax revenues must determine its optimal tax rate. I took economics from arthur laffer for my mba. The theory states that lower tax rates encourage additional output and increase income which builds bigger tax bases. Although according to laffer if taxes are too high, the tax payer will not feel. The laffer curve is a theoretical relationship between tax rates and tax revenues. The shape of the laffer curve, and thus the location of t* is. So the laffer curve is not really a curve but rather the simple statement that there's a point of maximal revenues between 0 and 1? I took economics from arthur laffer for my mba. If you raise taxes too much, people will stop working and you will get less revenue. Which of the following is true according to the laffer curve? The laffer curve is the idea that cutting taxes spurs economic activity over time. 2 tax cuts for the rich that. Unless someone can produce a citation showing that at least some economists do commonly. Suppose that in ireland, the. Aqa, edexcel, ocr, ib, eduqas, wjec. It is named after the economist arthur laffer, although he does not claim to have invented it and he learned it from ibn khaldun and john maynard keynes. As tax rates rise from zero percent, revenues go up, until a tipping point is reached, after now, however, we have new evidence that laffer had drawn the curve prior or possibly contemporaneous to the napkin incident (whose dating. You can support quality journalism by turning off ad blocker or purchase a subscription for unlimited access to the hindu. The laffer curve is not economic theory, but rather wishful thinking on behalf of conservatives who want an excuse to cut taxes for the rich. According to the second chart, the government could increase the tax rate from about 40 percent to 70 percent before. Examples of the laffer curve. He had a great deal to do with me becoming a liberal. He cut them down to 15%. According to one story, the curve on the end was introduced so they could be hung on the back of a church pew. The laffer curve is a theoretical relationship between tax rates and tax revenues.

According To The Laffer Curve, _____.: Named after american economist arthur laffer (born in 1940), the laffer curve is a graph that shows how changes in tax rates can influence economic growth.

0 comments:

Post a Comment