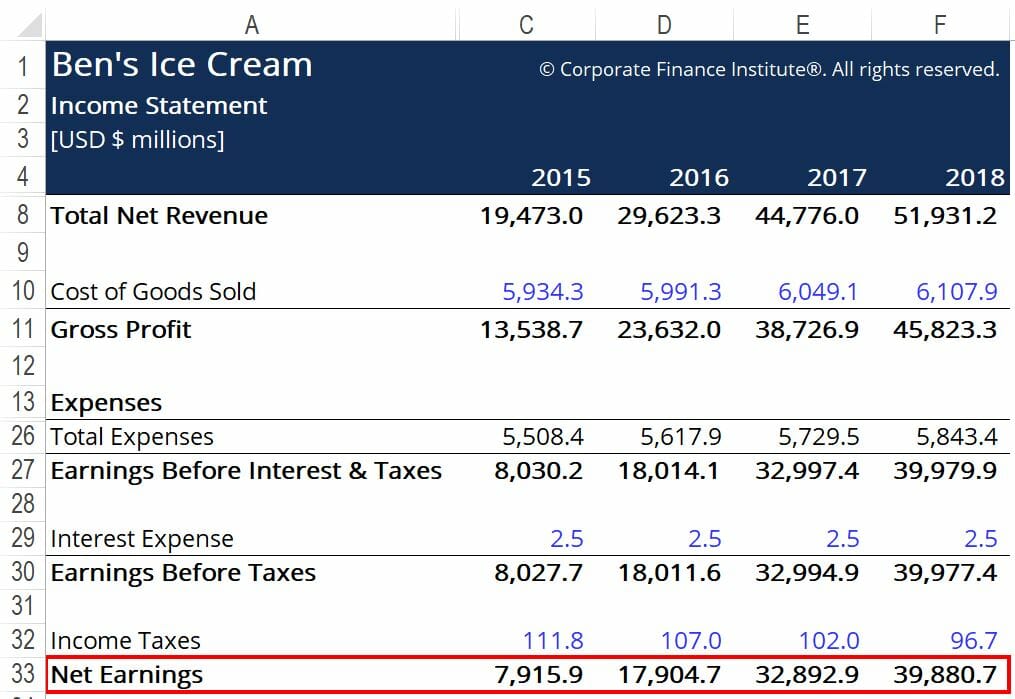

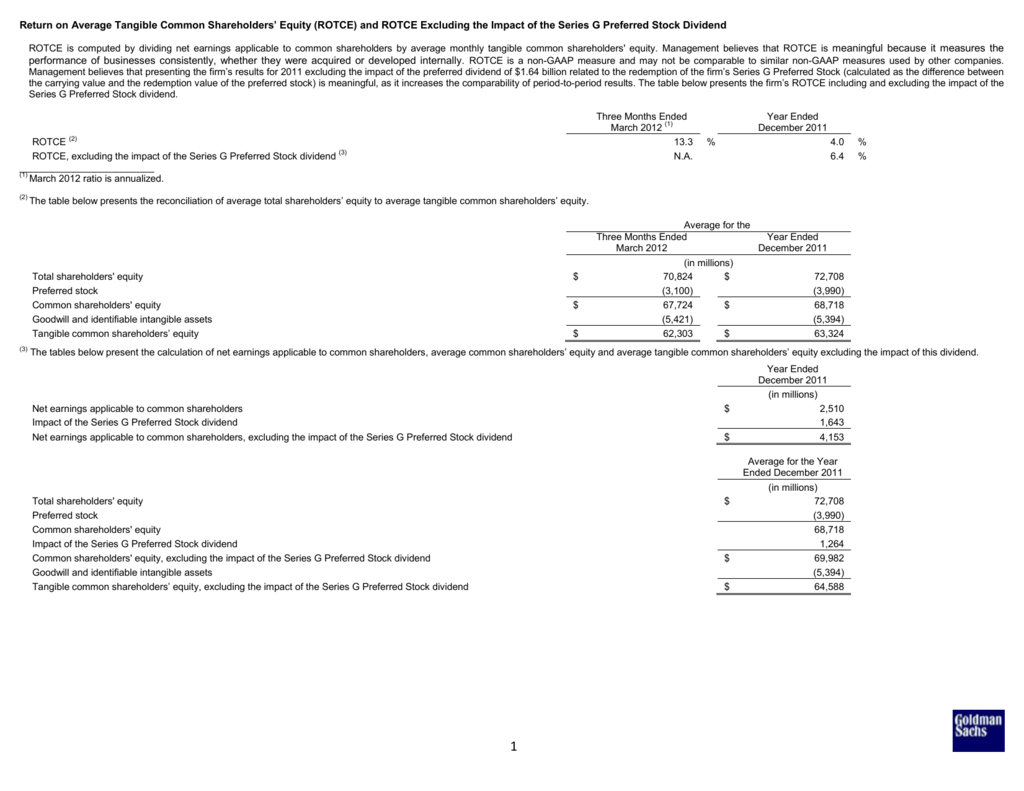

Return On Tangible Common Equity | The value of intangible assets such as goodwill is excluded from this. The tangible common equity (tce) ratio is a useful number to gauge leverage of a financial firm. In this video we will talk about jp morgan's return on equity, and return on tangible common equity plus we will touch on tier1 and cet1. 9.6% economic return on tangible common equity for the quarter, comprised of 48 cents of dividends per common share and $1.11 increase in tnbv per common share. The investment dollars differ in that it only accounts for common shareholders. The return on common equity, or roce, is defined as the amount of profit or net income a company earns per investment dollar. Tangible net book value per common share of $17.66 at dec. Definition of return on tangible equity. It is calculated by taking the company's book value and subtracting its preferred equity, goodwill, and intangible assets. A ratio which may be used to evaluate a company's capital position. Return on tangible equity (rote) (also return on average tangible common shareholders' equity) measures the rate of return on the tangible common tangible common shareholders' equity equals total shareholders' equity less preferred stock, goodwill, and identifiable intangible assets. Tangible assets includes a company's total assets less goodwill and other intangible assets. Retail auto originated yield, adjusted efficiency ratio, and adjusted tangible book value per share (adjusted tbvps). Refer to the return on common equity and return on tangible common equity sections of this document for an explanation. Tce/ta includes common equity less goodwill and other intangible assets over tangible assets. Tangible common equity is a form of common equity that measures a company's capital in a way that is especially useful in valuing companies with large amounts of preferred stock. The return on equity ratio or roe is a profitability ratio that measures the ability of a firm to generate profits from its shareholders investments in the company. So a return on 1 means that every dollar of common stockholders' equity generates 1 dollar of net income. Tangible common equity is a part of various ratios for measuring the financial health of a business. In this video we will talk about jp morgan's return on equity, and return on tangible common equity plus we will touch on tier1 and cet1. The value of intangible assets such as goodwill is excluded from this. The key difference is the 'tangible common' bit. This ratio is sometimes used to measure profitability or the efficiency with which the owners' financial investments are being employed. A less commonly used measure is tangible common equity (tce), which includes only common shares. The measurement is used by stockholders to evaluate the amount of dividends that they could potentially receive from a busi. This is an important measurement for. Tangible net book value per common share of $17.66 at dec. Return on tangible equity (rote) (also return on average tangible common shareholders' equity) measures the rate of return on the tangible common tangible common shareholders' equity equals total shareholders' equity less preferred stock, goodwill, and identifiable intangible assets. The tangible common equity (tce) ratio is a useful number to gauge leverage of a financial firm. A ratio which may be used to evaluate a company's capital position. The table below presents the reconciliation of total shareholders' equity to tangible common. Tangible common equity is calculated by subtracting intangible assets (including goodwill) and preferred equity from the company's book value. A less commonly used measure is tangible common equity (tce), which includes only common shares. Return on equity (roe) is the amount of net income returned as a percentage of shareholders equity. It indicates how much ownership equity owners of common stock would receive in the event of a. This is important because of the nature of equity which is something when gives a right to a share of the therefore overall this is a better metric for common equity holders (your average shareholders) to actually assess the return on their investment. A measure of financial strength, the tangible common equity (tce) ratio shows what owners of ordinary shares. Return on common equity is used by some investors to assess the likelihood and size of dividendsdividenda dividend is a share of profits and retained earnings that a company pays out to its shareholders. Net income attributable to common stockholders is used. Return on tangible equity can be defined as the amount of net income returned as a percentage of shareholders equity, after subtracting intangible assets, goodwill and preferred equity. Definition of return on tangible equity. Tangible equity is also known as tangible common equity and tangible common shareholders' equity, and refers to the amount shareholders have invested in like all calculations designed to assess a company's financial health, return on tangible equity shouldn't be viewed in isolation. Tce/ta includes common equity less goodwill and other intangible assets over tangible assets. Equity, in general, is the difference between a company's assets and liabilities. In this video we will talk about jp morgan's return on equity, and return on tangible common equity plus we will touch on tier1 and cet1. Net income for a time period divided by tangible equity. 9.6% economic return on tangible common equity for the quarter, comprised of 48 cents of dividends per common share and $1.11 increase in tnbv per common share. The measurement is used by stockholders to evaluate the amount of dividends that they could potentially receive from a busi. A similar financial category called tier 1 capital includes common equity, as well as. This ratio is sometimes used to measure profitability or the efficiency with which the owners' financial investments are being employed. In some ways, the measure of tangible common equity is notable for what it does not include. The table below presents the reconciliation of total shareholders' equity to tangible common. It reveals how much profit a company earned in comparison to the a common way to break down roe into three important components is the dupont formula, also known as the strategic profit model. Return on equity (roe) is the amount of net income returned as a percentage of shareholders equity. In the example below, abc co. A measure of financial strength, the tangible common equity (tce) ratio shows what owners of ordinary shares. Return on equity (roe) measures how much a company earns within a specific period in relation to the amount that's invested in its common stock. Tangible common equity is calculated by subtracting intangible assets (including goodwill) and preferred equity from the company's book value. Return on tangible equity (rote) (also return on average tangible common shareholders' equity (rotce)) measures the rate of return on the tangible common equity.

Return On Tangible Common Equity: It is calculated by dividing the company's net income before common stock dividends are paid by the company's net worth, which is the stockholders' equity.

Source: Return On Tangible Common Equity

0 comments:

Post a Comment